Banglarbhumi Land Revenue (Khajna) Application 2025 – Complete Online Guide

What is Banglarbhumi Land Revenue (Khajna) Application?

In West Bengal, land revenue (locally called Khajna) is the mandatory government fee paid by landowners to retain rights over their land. Traditionally, landowners had to visit revenue offices to pay Khajna. With the introduction of the Banglarbhumi portal, landowners now have the convenience of submitting their Khajna applications and making payments entirely through the online system. Every Khajna payment is routed through GRIPS, the state’s official payment gateway, and you can immediately download the digital receipt once the transaction is complete.

This guide explains the step-by-step process of applying for Banglarbhumi land revenue (Khajna), making payments online, and downloading receipts for future reference.

Who Can Apply for Banglarbhumi Land Revenue (Khajna)?

The facility is available for:

- Rayats (recorded landowners) whose names appear in Khatian records.

- Unrecorded owners who hold land but do not yet have official record updates.

Both categories must first log in to the Banglarbhumi portal before submitting their Khajna applications.

Documents and Details Required for Khajna Application

Before starting, keep the following ready:

- Khatian number and plot details

- District, Block, and Mouza name

- Applicant or family head details

- Category of land use — for example, whether the plot is agricultural, residential, or commercial

- Previous Khajna receipt (if available, for cross-checking)

Step 1: Create and Log In to Your Banglarbhumi Account

- Visit Banglarbhumi official portal.

- If you are new, click Sign Up → Citizen and complete the registration.

- Once registered, sign in to the portal using the login details you created during sign-up.

Without logging in, you cannot access the land revenue (Khajna) application module.

Step 2: Begin Your Banglarbhumi Land Revenue (Khajna) Request Online

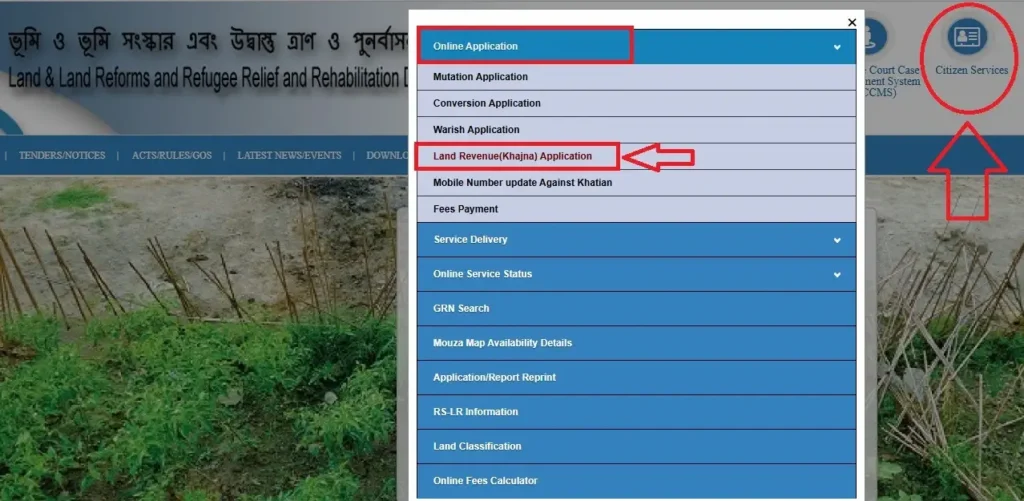

- After logging in, go to the Citizen Services menu on your dashboard and choose the option for Land Revenue (Khajna) Application.

- Choose your district, block, and mouza.

- Provide the applicant’s information, which is usually the family member in charge of managing the land.

- Provide the Khatian number; the system automatically retrieves the related plot details.

- Specify the land use category for each plot.

- Add details of family members (mark at least one as “Self”).

- Include unrecorded property information if applicable.

- Mention past Khajna payments and upload receipts if you have them.

- Submit the application. The system instantly generates a unique application number for further steps.

Step 3: Download the Application Acknowledgement

After submission, an acknowledgement slip containing your application number is available for download.

Path: Application Download → Enter application number → CAPTCHA → Submit.

This number is essential for completing your Khajna payment.

Step 4: Pay Khajna Fees Online via GRIPS

- Go to Citizen Services → Fees Payment.

- Select Request Type → Revenue (Khajna).

- Enter your application number and the CAPTCHA code.

- Verify the payment details displayed.

- After confirming the details, the portal automatically takes you to GRIPS, the state’s authorized payment gateway.

- Choose your preferred mode of payment (Net Banking, Debit/Credit Card, or UPI).

- Complete the payment.

- Once successful, GRIPS generates a unique Government Reference Number (GRN), confirming your transaction.

Your payment status is automatically updated on Banglarbhumi.

Step 5: Download Revenue Receipt or Reprint Application

Once payment is confirmed:

- Visit the Application/Receipt Reprint section on Banglarbhumi.

- Type in the application number, choose the correct Khatian, and confirm the security code to proceed.

- From this section, you’ll be able to save a copy of the submitted application as well as the receipt for your payment.

Alternatively, you can check or reprint receipts directly from GRIPS using the GRN Status/Challan Search option.

Troubleshooting Common Issues in Khajna Application

- Incorrect Khatian details → Verify through the “Know Your Property” section before applying.

- Payment failure → Retry only after confirming no money was deducted.

- Amount deducted but no receipt → Use GRN search in GRIPS to confirm the transaction and download the challan.

- Duplicate attempts → Always verify using your GRN before making another payment.

Offline Support: Bangla Sahayata Kendras (BSKs)

If you face problems while applying online, visit your nearest Bangla Sahayata Kendra (BSK). These centers provide assisted services for Banglarbhumi, GRIPS, and other state e-governance facilities.

Khajna vs Property Tax vs Stamp Duty – Key Differences

It’s common to confuse these terms, but they are distinct:

- Khajna (Land Revenue): Paid through Banglarbhumi and GRIPS for land ownership.

- Property Tax: Collected by municipalities via UDMA/OPTICS.

- Stamp Duty & Registration Fee: Applicable during property transactions, paid through the WB Registration portal.

Safety Tips for Khajna Payments

- Always use only the official Banglarbhumi and GRIPS portals.

- Save all application numbers, GRNs, and receipts for future reference.

- Avoid middlemen or unauthorized websites for making payments.

FAQs on Banglarbhumi Land Revenue (Khajna) Application

Q1. What is the online procedure for paying Khajna in West Bengal?

Login to Banglarbhumi → Go to Fees Payment → Revenue (Khajna) → Enter application number → Redirects to GRIPS → Complete payment → Download receipt.

Q2. Is payment through GRIPS mandatory?

Yes, Khajna dues in West Bengal are settled only through GRIPS, the Government Receipt Portal System.

Q3. What is a GRN?

The Government Reference Number (GRN) is a unique transaction ID generated by GRIPS. It helps track your payment.

Q4. Where can I get my Khajna receipt?

Receipts can be downloaded from Banglarbhumi (Application/Receipt Reprint) or from GRIPS Challan Search using the GRN.

Q5. Do I need a Khatian number for applying Khajna?

Yes, you must provide your Khatian number, as the portal uses it to automatically display the related land record information.

Q6. Is Khajna the same as property tax?

No. Property tax is municipal, while Khajna is land revenue collected by the state.

Q7. Can Bangla Sahayata Kendras help me with Khajna payment?

Yes, BSK centers provide step-by-step assistance with Banglarbhumi and GRIPS services.

Q8. What should I do if my payment fails?

Check if money has been debited. If yes but receipt is missing, verify through GRN Status in GRIPS and reprint.

Useful Links

Conclusion

The Banglarbhumi land revenue (Khajna) application has made revenue payments simple and transparent. With just your Khatian number, application number, and GRN, you can complete the process online and download official receipts from the comfort of your home.

By using Banglarbhumi and GRIPS, landowners in West Bengal can ensure safe and verified land revenue payments without visiting government offices.